Gold is typically a popular way to protect wealth due to its historical significance, stability, and universal appeal. If you’re new to the world of gold investments, welcome. Gold is an investment that many don’t think to turn to, but little do they know, it’s a great way to diversify and stabilise your portfolio. This guide will walk you through everything you need to know about how to purchase gold coins and other forms of physical gold in 2024.

Why Invest in Gold?

Gold has always been considered a safe investment, especially during times of economic uncertainty. Unlike paper currency, gold is immune to inflation and can’t be printed at will, which makes it an appealing option during financial crises.

Gold also serves as an excellent diversification tool. While stocks and bonds can fluctuate wildly, gold often moves in the opposite direction of the stock market, acting as a counterbalance to other financial assets. Many financial advisors recommend holding 5% to 10% of your portfolio in gold, and possibly up to 15% during periods of economic instability.

Different Ways to Invest in Gold

There are different ways to invest in gold, but the most conventional method is to purchase gold coins or bars. These are tangible assets that you physically own, which can provide a sense of security and reassurance during uncertain times. Here’s a breakdown of the most popular forms of physical gold investments:

Gold Bullion

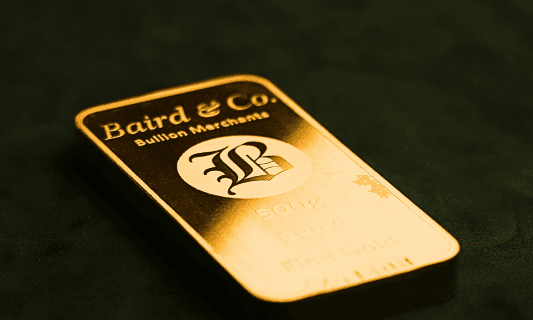

Gold bullion refers to gold in bulk form, typically bars or ingots, that is at least 99.5% pure. Gold bars come in various sizes, from small wafers to large bricks weighing over 12 kilograms. They are stamped with important details such as weight, purity, and origin.

Pros: Lower cost per gram compared to coins, excellent for storing large quantities of gold.

Cons: Less liquid than gold coins, and not as versatile for smaller investments.

Gold Coins

When you decide to purchase gold coins, you’re investing in a highly liquid and recognisable form of gold. Popular gold coins include the British Britannia, the Canadian Maple Leaf, and the South African Krugerrand. These coins are minted by governments and carry a premium over the spot price of gold, reflecting their collectability, rarity, and legal tender status.

Pros: Easy to buy and sell, more accessible for smaller investments, and often carry an intrinsic aesthetic value.

Cons: Higher premiums compared to gold bars, and storage can become cumbersome if accumulating a large amount.

How to Purchase Gold Coins in the UK

If you’re ready to invest, there are a few key steps to follow to ensure you make a smart purchase:

1. Choose the Right Type of Gold Coin

Not all gold coins are created equal. Investment-grade coins are those that are minted specifically for investors and have a high purity level, usually 22 or 24 carats. These coins are easier to buy, sell, and value compared to collectable coins, which might carry additional premiums based on rarity rather than gold content.

For UK investors, popular choices include:

Gold Britannias: Recognised worldwide and exempt from UK Capital Gains Tax (CGT) due to their status as legal tender.

Gold Sovereigns: Another CGT-exempt coin, slightly smaller than Britannias, making them ideal for fractional investments.

2. Buy from Reputable Dealers

When you purchase gold coins, it’s crucial to buy from reputable sources. This can be through established bullion dealers, banks, or the Royal Mint. Online platforms, like Baird Mint, provide convenience and competitive pricing, allowing you to easily compare options and find the best deals. Just be sure to choose platforms with positive reviews and a solid reputation to ensure a safe and genuine purchase experience.

Look for dealers who are members of the British Numismatic Trade Association (BNTA) or have strong ratings and reviews from previous customers. This will ensure that you’re getting genuine products at fair prices.

3. Understand the Costs Involved

The price you pay to purchase gold coins includes more than just the current market value of gold, also known as the spot price. There are additional costs to consider:

Premiums: This is the markup above the spot price that covers minting, distribution, and dealer margins. Premiums can range from 1% to 5% or more, depending on the coin and dealer.

Shipping and Insurance: If you’re buying online, factor in shipping and insurance costs to protect your investment during transit.

4. Plan for Storage and Security

Storing your gold safely is essential. While some investors choose to keep their gold at home in safes, this comes with risks such as theft or damage. A more secure option is to use a professional storage service, also known as a bullion vault or depository.

Home Storage: Be sure to invest in a high-quality safe and consider insurance specifically for your gold holdings.

Professional Storage: Using a professional storage service provides numerous benefits. Our vault locations are monitored with 24/7 CCTV surveillance by a leading security company, ensuring the highest level of protection for your assets. This storage option also offers great flexibility—you can add additional items at any time, and if you decide to sell, your stored items can be easily sold back to Baird at the prevailing market rate. Another advantage is the VAT-free purchase and sale of gold, silver, platinum, and palladium products stored in our vaults, helping you maximise the value of your investment.

5. Know When to Buy

Timing your purchase can make a significant difference in your investment outcome. While it’s tempting to buy during a financial crisis, when gold is in high demand, prices are usually elevated. Consider buying during more stable periods when prices may be lower, allowing you to accumulate gold at a better value.

Other Ways to Invest in Gold

While physical gold is a solid choice for many, there are other options for those looking to diversify their exposure to the metal without actually holding it:

Gold ETFs: Exchange-traded funds that track the price of gold, providing an easy way to invest without worrying about storage or insurance.

Gold Mining Stocks: Shares in companies that mine gold, offering potentially higher returns but also greater risk.

Gold Futures and Options: Contracts that allow you to speculate on the future price of gold, suitable only for experienced investors.

Is Gold the Right Investment for You?

Investing in gold, especially when you purchase gold coins, offers stability and protection during uncertain times. However, it’s not without its drawbacks. Physical gold doesn’t generate income, and storage and insurance can be costly. For these reasons, gold is best viewed as part of a diversified portfolio rather than the sole focus of your investment strategy.

Final Thoughts

Buying gold can be a wise move for investors looking to protect their wealth against economic uncertainty. With the right approach, you can enjoy the benefits of this timeless asset and feel secure in your investment decisions.

If you're looking to make your first purchase or expand your existing collection, visit our website to explore our wide range of gold coins and bullion. Our experts are here to help you every step of the way. Happy investing!